Possibly one of the worst disadvantages of getting a TSP loan is if you leave your federal service job before paying off the loan in full, you have only 90 days to repay the loan if you cannot do so or fail to meet the deadline the entire loan is reported to the IRS as income. Many other lenders do not charge a processing fee for taking your application for a loan.Ĭon: 90-Day Repayment if Your Leave Your Job Con: Application FeeĪ disadvantage over many other loans is that they charge a $50 application processing fee directly out of your loan funds when you get your loan funds.

You do not have to provide a lot of paperwork, proof of income, and other information like you would other lenders.

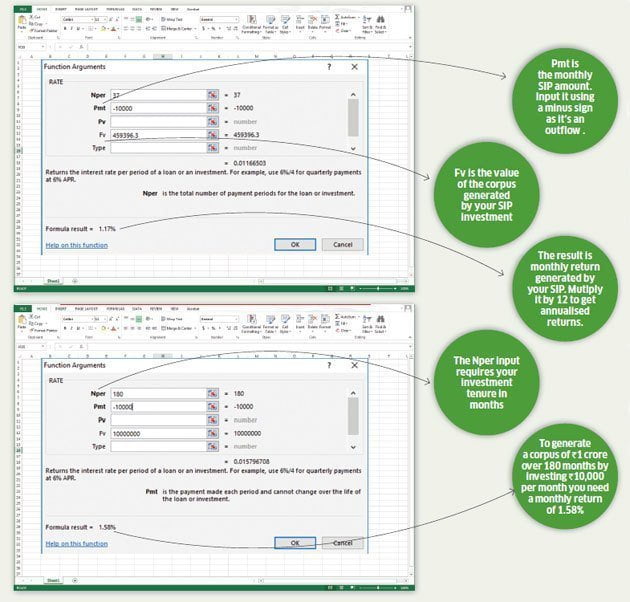

Second, you can re-amortize the lower balance and lower your monthly payments. One, you can pay it off early and no longer have to worry about the loan. There are a couple of advantages to paying an additional payment on your loan. Though, you can set up payments to be taken straight out of your bank account at most lenders or set up a monthly automatic online payment paid each month. Pro: Payments by Payroll DeductionĪnother advantage of a TSP loan is that you can have the payment conveniently set up to be taken out of your paycheck each pay period. You can also access a loan calculator at the TSP loan website at. You can go to a loan calculator at this website and enter the terms, and it will tell you the amount your payment will be: Loan Calculator (). The same loan over five years from a lender at the higher interest rate of 35.99% would have payments of $361.27. This amount is only about a $20 difference. The same $10,000 loan borrowed from a different lender with a rate of %.99% would have payments of $193.28 per month. A $10,000 TSP loan at 1.50% over five years would have payments of $173.10 per month with a total interest paid back of $385.93. You can typically borrow any amount between $1000 and $50,000 if you have enough in your account to cover it. The current TSP loan rate is 1.50%, which is the current rate on a G Fund, which is generally the interest rate based on the TSP loan. These examples are from Bankrate at Best Personal Loan Rates for July 2021 | Bankrate. Most other personal loans available as personal loans typically have an interest rate of 2.49% to 35.99%. The interest rate is generally less than two percent. Pro: Low-Interest RateĪ TSP loan has the advantage of having a low interest rate compared to many other types of loans. This article will look specifically at those pros and cons to help you know the advantages or disadvantages of getting a TSP loan. You may wonder about the pros and cons of lending against a TSP and whether it is a good idea. Thrift Savings Plans or TSP are designed to help federal employees and the military to have some of the same benefits the private sector gets in a 401 (k) plan, but they can borrow money from their plan.

0 kommentar(er)

0 kommentar(er)